japan corporate tax rate 2020

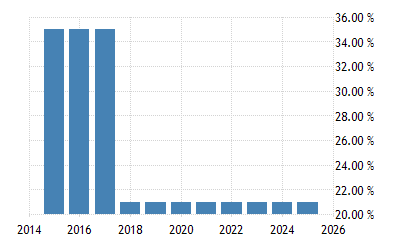

The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a share capital which exceeds JPY 100 million USD 896387. Corporate Tax Rate in Japan averaged 4119 percent from 1993 until 2020 reaching an all time high.

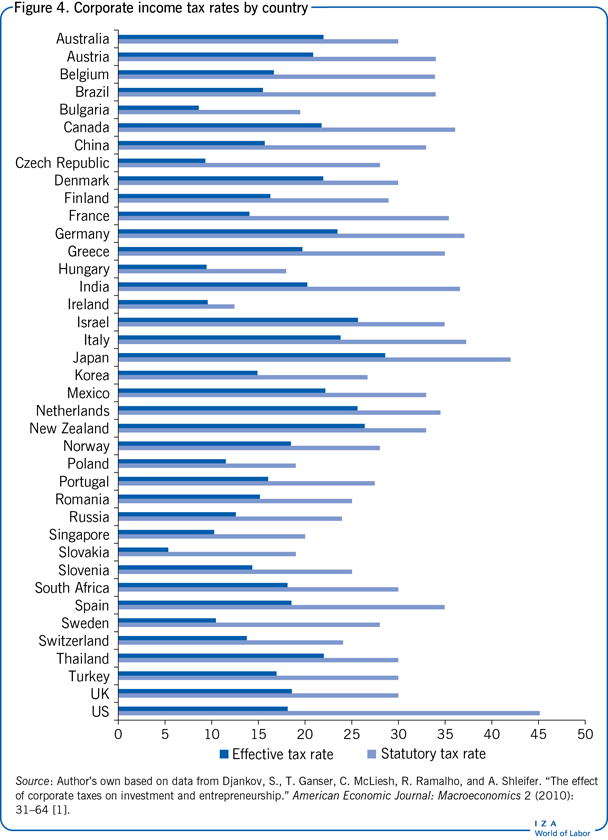

Iza World Of Labor Corporate Income Taxes And Entrepreneurship

For small and medium-sized enterprises the first 8 million.

. A tax cut on capital shifted back to Japan from overseas subsidiaries may help stem the yens rapid depreciation some economists say. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with. Major difference from the rules of the consolidated tax system are.

Income from 0 to 1950000. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching. Stock Shorts Fold in Best Two-Day Rally Since 2020.

The Corporate Tax Rate in Japan stands at 3062 percent. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. Income from 1950001 to.

Corporate tax amount is 10 million yen or less per annum and taxable income is 25 million yen or less per annum. Japan Income Tax Tables in 2020. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Data published Yearly by National Tax Agency. The average tax rate among the 223 jurisdictions is 2257 percent. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching. Corporate Tax Rate in Japan averaged 4083 percent.

Tax rates The tax rates applied to profit and loss sharing groups will be the respective tax rates applied to each individual entity in accordance with its corporate. Under the 2020 Tax Reform Act the interest rate applied by tax offices on delinquency tax and on refunds paid to taxpayers will be reduced from the current 16 per annum to 11. 5 for holding at least 10 direct or indirect shares for.

Corporate Tax Rate in Japan averaged 4083 percent from. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Taxable income over 10 million.

The current income tax rate for corporates with paid-in capital of over 100 million yen is at 232. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Exempted when paid by a company of Japan holding at least 15 direct or indirect or 25 direct shares for six months.

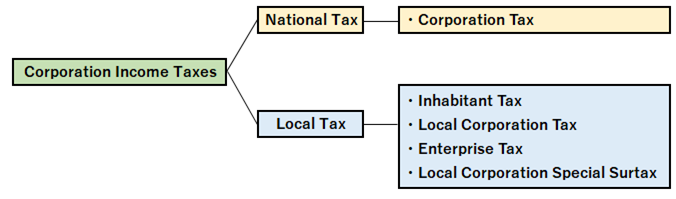

7 rows National local corporate tax. Beginning from 1 October 2019 corporate taxpayers are required. Corporate Income Tax.

In Japan the Corporate Income tax rate refers to the. Offices or factories located in up to two prefectures. Reducing the tax applied to repatriated funds would fuel an inflow of yen back into Japan on a scale that.

The maximum rate was 524 and minimum was 3062. I the parent corporation and each subsidiary would file their own blue form corporate tax returns. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

Corporation Tax Europe 2021 Statista

Economy And Politics 10 Talking Points Neither Party Will Give You

Japan Clears Way For Corporate Tax Cut Wsj

G7 Corporate Tax Rate 1980 2020 Oc R Dataisbeautiful

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Real Estate Related Taxes And Fees In Japan

Scare Tactics For Corporate Tax Cuts Do Not Stand Fact Checks The Australia Institute

George Eaton On Twitter The Race To The Bottom Has Finally Been Halted After 40 Years Minimum Global Corporate Tax Rate Of At Least 15 Has Now Been Agreed By G7

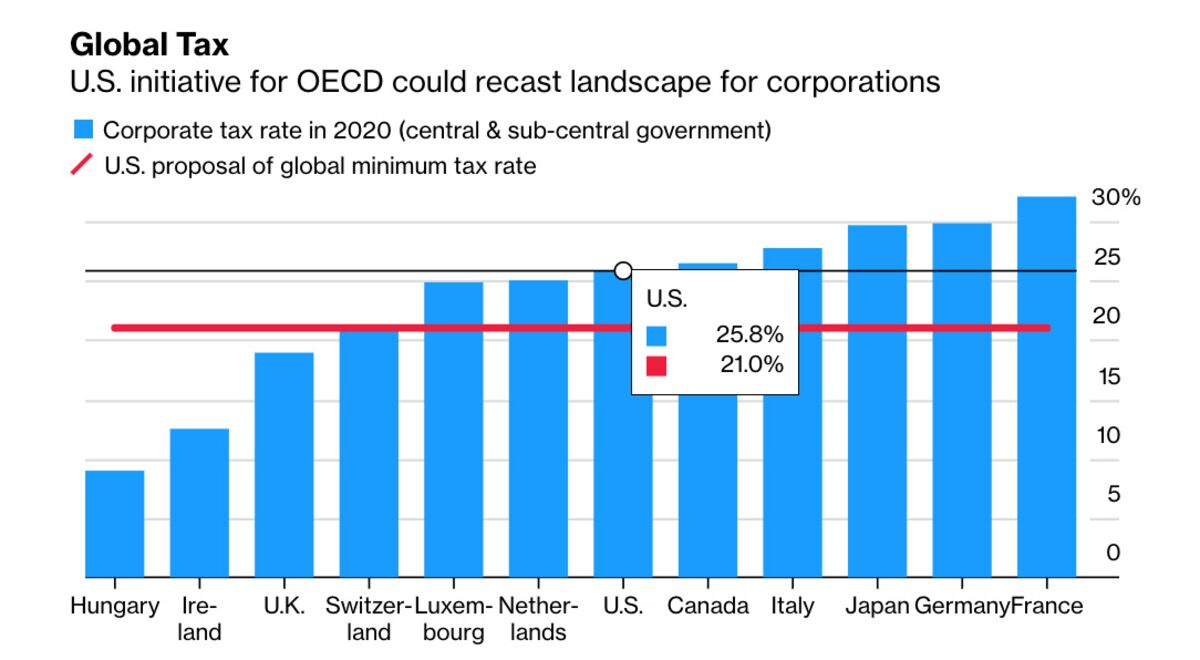

Global Tax Gains Momentum With Dutch Minister Seeing Summer Deal Bloomberg

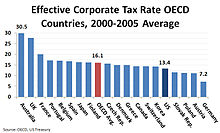

G20 Corporation Tax Rates As Of 1st April 2015 Download Scientific Diagram

Corporate Tax In The United States Wikipedia

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

Japan S Carbon Tax Policy Limitations And Policy Suggestions Sciencedirect

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

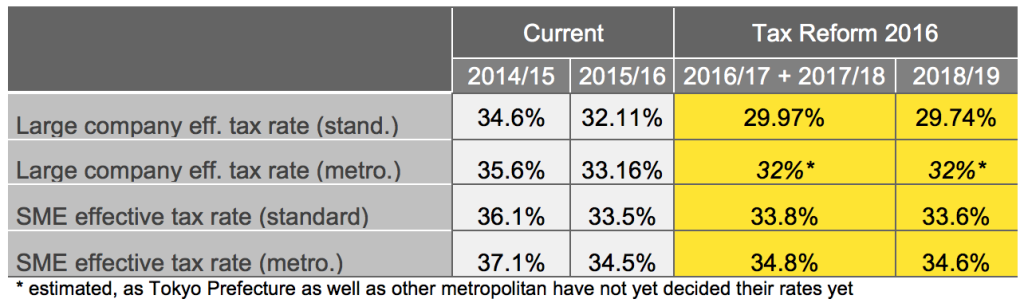

Japan Tax Reform 2016 Japan Industry News

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Corporate Income Tax Return Filing In Japan Latest 2021 2022 Shimada Associates

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation